Millions of federal student loan borrowers can now apply for debt relief under a Biden administration program.

Borrowers are eligible for up to $10,000 in student loan forgiveness under the plan if their income was below $125,000 for individuals or $250,000 for couples in 2021 or 2020. Those who received a Pell Grant in college and meet the same income thresholds can receive up to $20,000 in relief.

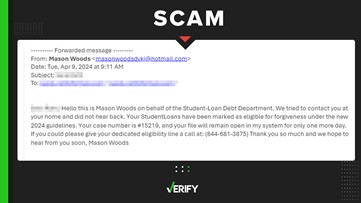

Several weeks before the application launched, some people on social media claimed that the Department of Education made changes to the program, excluding some borrowers who were previously eligible for relief. Google Trends data also show that people are searching for information about a “student loan forgiveness reversal.”

More from VERIFY: Fast Facts about student loan forgiveness

THE QUESTION

Did the Biden administration make a change to the student loan forgiveness plan that excludes some borrowers from relief?

THE SOURCES

- The U.S. Department of Education

- Wayback Machine, an internet archiving tool

- Jessica Thompson, vice president at the Institute for College Access and Success

THE ANSWER

Yes, the Biden administration made a change to the student loan forgiveness plan that excludes some borrowers from relief.

Borrowers with federal student loans that are not held by the Department of Education are now ineligible for debt relief if they didn’t apply for consolidation before Sept. 29, 2022, the department says.

WHAT WE FOUND

Some borrowers with federal student loans that are held by private lenders are now ineligible for the Biden administration’s debt relief if they haven’t already applied for consolidation, which allows federal student loan borrowers to combine multiple loans into one.

“As of Sept. 29, 2022, borrowers with federal student loans not held by ED cannot obtain one-time debt relief by consolidating those loans into Direct Loans,” the Department of Education’s website on student loan forgiveness reads.

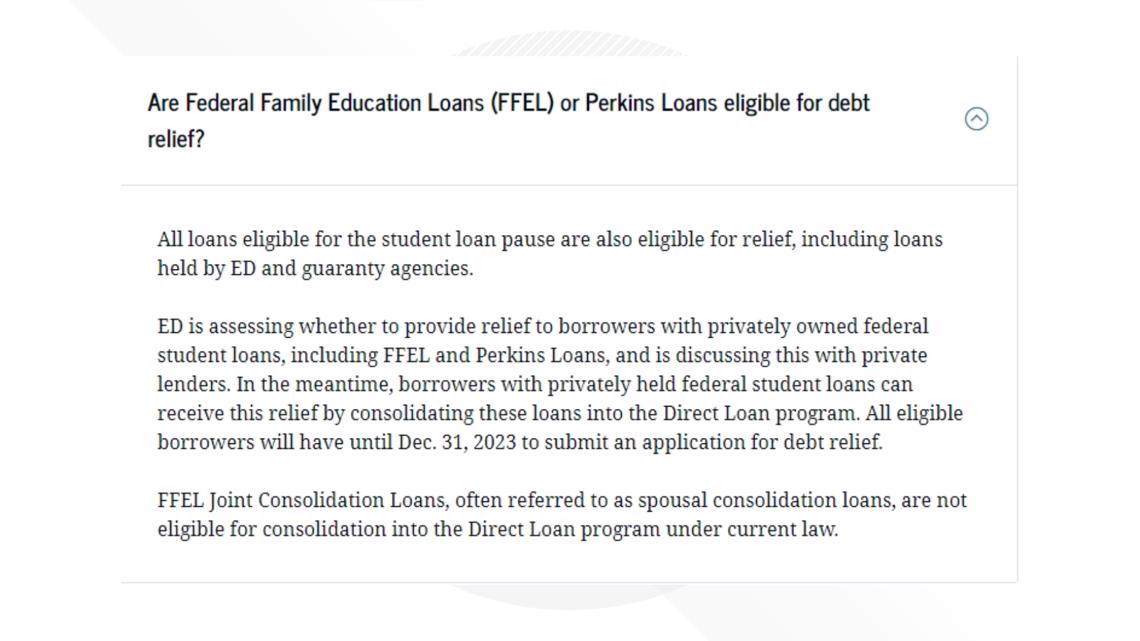

This includes borrowers with Federal Family Education Loan (FFEL) Program and Perkins Loans that are not held by the Department of Education. If these borrowers applied to consolidate their loans into the Department of Education’s federal Direct Loan program before Sept. 29, 2022, they are still eligible for student loan forgiveness.

The FFEL Program, which offered federally backed loans that were funded by private lenders, ended in 2010. Perkins Loans, which were issued by schools, have not been disbursed since June 30, 2018.

More from VERIFY: Fast Facts about how student debt relief will be applied for borrowers with multiple loans

The exclusion of FFEL and Perkins borrowers who have not applied to consolidate their loans is a reversal from language previously included on the department’s website.

An archived webpage from Sept. 27, 2022, shows that the department said borrowers with privately held federal student loans could receive relief “by consolidating these loans into the Direct Loan program.” These borrowers, along with others who have student loan debt, would have until Dec. 31, 2023, to submit an application for relief, the website previously said.

But with the most recent update, those borrowers with loans held by private lenders who have not consolidated them no longer qualify for relief under Biden’s plan. However, the department said it is “still assessing whether there are alternative pathways to provide relief to borrowers with federal student loans not held by ED, including FFEL Program and Perkins Loans, and is discussing with private lenders.”

The most recent federal data available shows that just over 4 million borrowers have student loans that are not held by the Department of Education, Jessica Thompson, vice president at the Institute for College Access and Success, told VERIFY. But Biden administration and Department of Education officials did not answer questions about exactly how many borrowers the recent change to its plan would affect.

No other student loan borrowers are excluded from forgiveness as of the department’s latest update, Thompson confirmed.

More from VERIFY: Yes, you can get a refund if you paid federal student loans during the payment pause

When VERIFY asked the department why it is now excluding FFEL and Perkins borrowers from the Biden administration’s student loan forgiveness plan, a spokesperson said its goal is to “provide relief to as many eligible borrowers as quickly and easily as possible, and this will allow us to achieve that goal while we continue to explore additional legally available options to provide relief to borrowers with privately owned FFEL loans and Perkins loans, including whether FFEL borrowers could receive one-time debt relief without needing to consolidate.”

Thompson believes the Department of Education made it clear through its statement that “it is concerned about a legal challenge from private businesses who hold those loans.” That’s because the Department of Education would provide a “very strong incentive for borrowers to consolidate and therefore shrink their portfolios – meaning a loss of borrowers, and therefore revenue,” she added.

This comes as six states recently filed a federal lawsuit over the Biden administration’s student loan forgiveness program, asking for an immediate temporary restraining order pausing the program.

How to check if you have privately held federal student loans

People who are unsure whether their loans are held by the Department of Education can check by logging in to their Federal Student Aid (FSA) account and selecting “My Aid” in the dropdown menu under their name. In the “Loan Breakdown” section, you’ll see a list of each loan you received.

If you expand “View Loans” and select the “View Loan Details” arrow next to the loan, you’ll see the more detailed names for your loans.

The name of your servicer will start with “Dept. of Ed” or “Default Management Collection System” if your loans are held by the Department of Education. Servicer names are also visible in the “My Aid” section.