Each year, the open enrollment period for acquiring healthcare coverage through the Affordable Care Act marketplace generally begins Nov. 1 and ends Jan. 15 of the following year. The Biden-Harris administration announced that Healthcare.gov consumers can begin previewing potential plans in detail Oct. 25

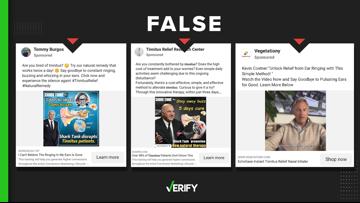

Ads for healthcare plans that sound too good to be true hit the web and the airwaves before and during every open enrollment period. VERIFY reader Ruth asked if a website claiming people could get “$0 free health insurance” with a $6,400 subsidy or allowance to pay for everyday expenses was a scam. Social media posts have also asked if these same ads are real.

VERIFY looked through Facebook’s Ad Library for examples of the ad Ruth saw or similar ads. Several ads VERIFY found promoted a “$0 health plan” with a “$6,400 allowance benefit.” These ads and others included links to websites urging people to find out if they qualify for “$6,400 premium health credits” or a “flex card at absolutely no cost.” One website even asked people to share their Social Security number and other personal information to get help enrolling in a free healthcare plan.

THE QUESTION

Can you get a free health insurance plan with a $6,400 spending allowance?

THE SOURCES

- Centers for Medicare and Medicaid Services (CMS) spokesperson

- Federal Trade Commission (FTC)

- KFF, a nonprofit organization focused on health policy

- Better Business Bureau (BBB)

- AARP

- GoodRx

- VERIFY analysis of health plans offered by major insurers

THE ANSWER

No, you can’t get a free health insurance plan with a $6,400 spending allowance.

WHAT WE FOUND

Social media ads that claim you can get a free health insurance plan that includes a $6,400 spending allowance or credit are either exaggerating the potential benefits of real plans or are straight up trying to scam you.

“One of the hallmarks of a fake health insurance plan is to claim to offer full benefits at an almost ‘too good to be true’ price,” GoodRx says.

“Trust your instinct. If something sounds too good to be true, it probably is,” the AARP says.

There is a real, currently available Affordable Care Act (ACA) subsidy that is vaguely similar to the subsidy these ads claim can get you both a “$0 health plan” and a “$6,400 allowance benefit.” But anyone eligible for this subsidy won’t ever see cash from it.

According to KFF, a nonprofit organization focused on health policy, healthcare marketplace consumers with low incomes can get what’s called a premium tax credit, which have been temporarily expanded by the Inflation Reduction Act.

The premium tax credit is designed to lower consumers’ monthly premiums — the amount a person pays for their healthcare plan each month. If a person chooses to get their tax credit in advance, then the government will pay it directly to the consumer’s insurer each month. If they don’t choose advance payments, then the consumer will get their tax credit when they file their tax return.

If the credit is large enough, a plan’s premium low enough and a person chooses the advanced credit, then it’s possible the consumer won’t have a monthly out-of-pocket payment to maintain their health coverage. But the consumer will not end up with an “allowance benefit” as a result of this.

The website that Ruth sent VERIFY lists the logos of several real health insurance companies: UnitedHealthcare, Anthem, Aetna, Humana, Cigna and Kaiser Permanente.

VERIFY searched online for each company’s name plus “$6,400 allowance.” VERIFY could not find any plans offered by these companies that include a $6,400 allowance for everyday spending.

Instead, when “$6,400” came up in the documents detailing the companies’ insurance plans, it was because that was the overall deductible or the out-of-pocket spending limit.

Pages about health insurance subsidies on Cigna’s and Anthem’s websites do not mention anything about offering cash consumers can use for everyday expenses.

However, a Centers for Medicare and Medicaid Services (CMS) spokesperson told VERIFY that there are Medicare Advantage (MA) plans that offer supplemental benefits. These plans may offer the consumer a debit card sometimes called a Spending Card or FlexCard to spend these supplemental benefits.

These cards are only available as part of some Medicare Advantage plans and are distributed to cover some health-related expenses, such as over-the-counter medicine, dental care copays and other out-of-pocket costs, and can also provide a grocery allowance for healthful food such as produce, AARP says.

These cards are not provided by Original Medicare. They have also been used as bait to trick people into falling for scams.

“Some advertisements claim that Medicare is giving out flex cards containing several hundred dollars to apply toward food and other items,” AARP warned in 2022. “This particular scam directs you to a website where you’ll be asked to provide personal information that can be stolen, such as a Social Security number, credit card number or bank account information.”

Spotting and avoiding healthcare open enrollment scams

You should be able to get quotes for plans on the government’s healthcare marketplace without giving up your personal information, and you should be able to receive help navigating it without spending any money.

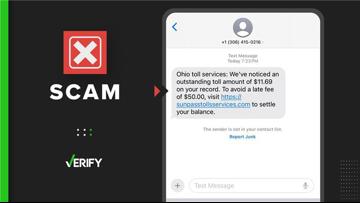

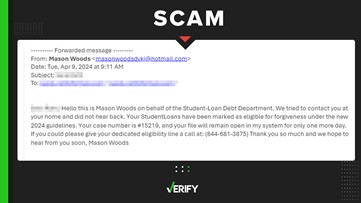

“The Affordable Care Act’s (ACA’s) official government site is HealthCare.gov. It lets you compare prices on health insurance plans, check your eligibility for healthcare subsidies, and begin enrollment,” the Federal Trade Commission (FTC) says. “But HealthCare.gov will only ask for your monthly income and your age to give you a price quote. Never enter personal financial information like your Social Security, bank account, or credit card number to get a quote for health insurance. You’ll be setting yourself up for robocalls or much worse — identity theft.”

There are also people who offer legitimate help navigating the health insurance marketplace, the FTC says. These people, sometimes called navigators or assisters, are not allowed to charge you and won’t ask you for personal or financial information.

The CMS spokesperson told VERIFY that a consumer can confirm if an agent, broker, or assister is certified and registered with the marketplace by calling the marketplace for assistance at 1-800-318-2596.

You should never offer your Medicare ID number, Social Security number, health plan information or banking information to anyone you don’t know, the Better Business Bureau (BBB) says.

Health insurance scammers use similar tactics as all other kinds of scammers. GoodRx warns that scammers are often pushy or even aggressive with their demands. One common tactic is to pressure you to make an immediate decision on the “deal of a lifetime” because it will expire soon.

The best way to avoid health insurance scams is to stick to official sites and resources. Find information on or shop for healthcare plans on the government’s healthcare.gov and medicare.gov websites.

If you suspect you’ve fallen for a scam, the CMS spokesperson said to report it to the FTC and contact your local police department. You can also contact the marketplace’s call center; once you’ve explained what happened, they’ll take the appropriate next steps to protect your information.