UPDATE (6/30/23): The Supreme Court has struck down the Biden administration's one-time student loan forgiveness plan. Loan repayments are expected to resume later this summer. You can read more information here.

Nearly 43 million Americans are eligible for student loan relief, according to White House estimates. To scammers, that means a big pool of potential victims.

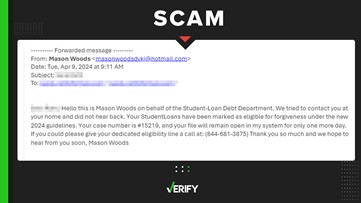

After the Biden administration announced its plan to forgive some federal student loan debt, several VERIFY viewers reached out to our team about suspicious calls they recently received from people claiming to offer student debt relief.

Antonietta sent us a text that said someone called her saying she needed to pay $1,600 upfront to forgive her student loans. Leslie said in an email that she got a call from someone offering her student loan forgiveness and restructuring. They both want to know if these are scams.

Here are five key things to look out for in student loan scams.

THE SOURCES

- U.S. Department of Education

- Better Business Bureau

- U.S. Federal Trade Commission

- Credible

- Abby Shafroth, director of the Student Loan Borrower Assistance Project at the National Consumer Law Center

WHAT WE FOUND

On Aug. 24, the Biden administration announced its plan to erase up to $10,000 in federal student loan debt for borrowers with incomes below $125,000 a year, or households that earn less than $250,000. An additional $10,000 will also be canceled for individuals who received federal Pell Grants to attend college.

Since the student loan forgiveness plan was announced, the Better Business Bureau (BBB) says reports from people who say they have been targets of fake student loan forgiveness calls and messages are on the rise. The BBB says these scammers have been reaching out to people through unsolicited phone calls, emails or text messages.

More from VERIFY: Fast Facts about student loan forgiveness

Here are five key things to watch for when assessing whether something is a student loan scam:

1. Asks for payment

Scammers often trick victims into providing unnecessary payment for free government programs – or they claim you can get additional or faster benefits upfront for a fee, but the BBB says a real government agency, such as the U.S. Department of Education, will never ask for an advanced processing fee for student loan relief.

Participating in the Biden administration’s student loan forgiveness program is free. Abby Shafroth, director of the Student Loan Borrower Assistance Project at the National Consumer Law Center, told VERIFY that borrowers “do not have to pay for this relief.”

“This relief is freely available,” Shafroth said. “If you get these calls, hang up the phone. You don't need to pay anyone for help.”

If you are having difficulty repaying your student loans, the Department of Education and Federal Trade Commission (FTC) both say you should contact your loan servicer.

2. Asks you to share personal information, such as your Federal Student Aid (FSA) ID or bank account information

The FTC says some scammers claim they need your Federal Student Aid (FSA) ID to help forgive your student loans, but they may actually use that information to try to steal your identity instead.

“Don’t share your FSA ID with anyone. Dishonest people could use that information to get into your account and steal your identity,” the FTC warns.

Credible, a personal finance financial technology company, and the BBB say some scammers may also ask borrowers to fill out an online application or sign a third-party authorization form or power of attorney to get debt forgiveness.

If a person does this, Credible warns that the scammer is then authorized to talk to the individual’s federal loan servicer and make decisions on their behalf — they could even change personal account information. But Credible says “a reputable company will never ask you to sign a power of attorney form.”

3. Promises immediate student loan relief

Some student loan borrowers are eligible for specific federal student loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) and the Teacher Loan Forgiveness programs, but none of these programs provide immediate student loan relief, as some scammers claim.

For instance, the PSLF program requires individuals to make 10 years’ worth of qualifying payments (totaling 120 payments) before forgiving the full remaining balance. Meanwhile, the Biden administration’s student loan forgiveness plan is still being finalized by the federal government.

More from VERIFY: Yes, eligible public service workers can still get full federal student loan forgiveness

The Department of Education says that some federal student loan borrowers will need to fill out a “simple application” to get debt forgiveness if the agency doesn’t have their income data. This is because many borrowers have not been required to certify their income during the student loan repayment pause that began in March 2020, according to Shafroth.

At this time, there isn’t a confirmed launch date for the application, but the Department of Education and the White House both say it will be available before the repayment pause ends on Dec. 31, 2022.

Borrowers who would like to be notified when the application is available can sign up with their email address on the Department of Education’s subscription page. Make sure to check the box marked “Federal Student Loan Borrower Updates.”

4. Uses “strong advertising language”

The Department of Education warns borrowers to beware of scammers who use “strong advertising language” when they reach out to them, including the following examples:

- “Act immediately to qualify for student loan forgiveness before the program is discontinued.”

- “Your student loans may qualify for complete discharge. Enrollments are first come, first served.”

- “Student alerts: Your student loan is flagged for forgiveness pending verification. Call now!”

“Though the U.S. Department of Education (ED) may reach out to highlight temporary programs like the limited PSLF waiver, aggressive advertising language like the above will not come from ED or our partners,” the Department of Education writes on its website.

The BBB notes that government agencies, including the Department of Education, will not reach out to individuals unless they request to be contacted first.

“If you receive a message that seems legitimate, but you aren’t sure, stop communicating with the person who contacted you. Then, verify their claims by contacting the government agency they say they represent,” the BBB says. “Out-of-the-blue communications are a red flag.”

5. Claims to be affiliated with the Department of Education or another government agency

Credible says some scammers use Department of Education logos to make themselves appear legitimate. They also might try to go by an official-sounding name while claiming to have partnered with the Department of Education to offer student loan forgiveness.

But the Department of Education does not partner with or authorize any organization to handle federal student loans outside of its contracted federal loan servicers, according to Credible.

Here are a few ways to make sure a federal government website is legit:

- Look at the web address and make sure it ends in “.gov” to see if it’s genuinely affiliated with the federal government.

- Keep an eye out for spelling or grammar mistakes, as these can indicate that the site is fake.

- If a phone number is listed, plug it into a search engine to see if it belongs to a legitimate government office or to a scammer.

“If you need help with your federal student loans or are pursuing some form of student loan forgiveness, make sure you’re contacting an ED-affiliated company that you can trust. Review our list of contracted federal loan servicers before reaching out to a potential partner,” the Department of Education says.

How to report student loan forgiveness scams

If you are the victim of a student loan forgiveness scam, you can submit a complaint to the Department of Education. You can also report the scam to the FTC, Consumer Finance Protection Bureau (CFPB), or your state attorney general.

More from VERIFY: Yes, there is a way to check if you received a Pell Grant