Throughout the COVID-19 pandemic, there’s been a long list of scams and schemes circulating in relation to coronavirus tax relief and Economic Impact Payments, also known as stimulus checks. This issue has been so prevalent that in July 2020, the IRS released a “Dirty Dozen” list of tax scams, urging Americans to remain vigilant during the pandemic and its aftermath.

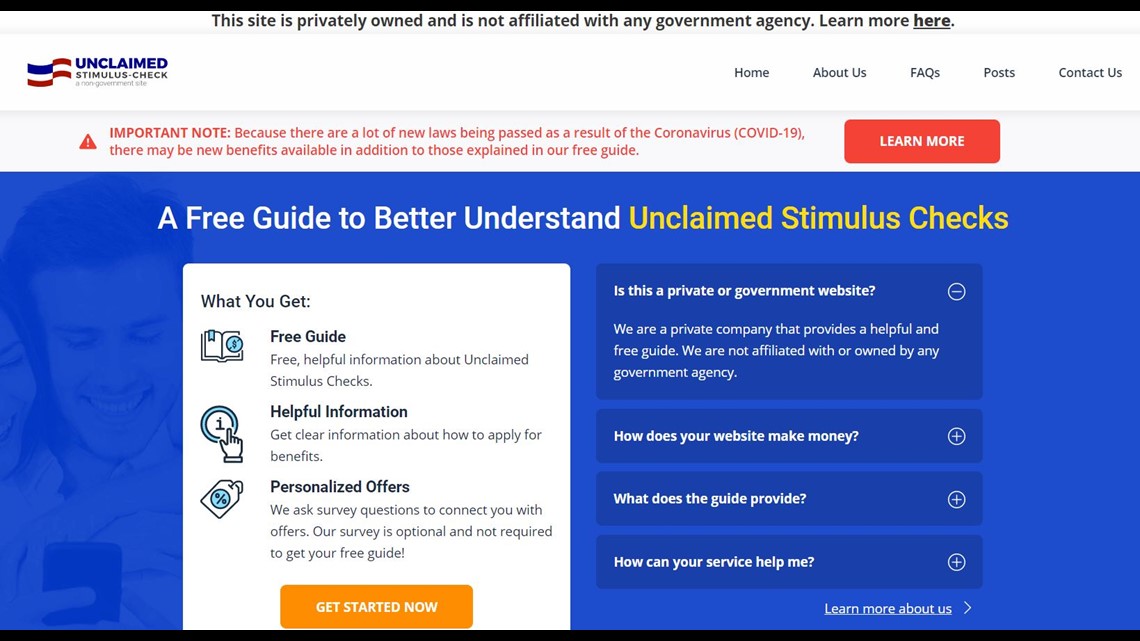

On May 17, VERIFY viewer Diane received an email from a non-government website claiming it would help her find unclaimed stimulus check money.

THE QUESTION

Are scammers making fake unclaimed stimulus check websites?

THE SOURCES

- Internal Revenue Service (IRS)

- Seena Gressin, attorney, Division of Consumer & Business Education at the Federal Trade Commission (FTC)

THE ANSWER

Yes, scammers are making fake unclaimed stimulus check websites.

WHAT WE FOUND

On the IRS’s “Dirty Dozen” list, the agency warns: “Taxpayers should be alert to potential fake emails or websites looking to steal personal information. The IRS will never initiate contact with taxpayers via email about a tax bill, refund or Economic Impact Payments.”

While the website that emailed Diane claims it’s a private company in no way affiliated with any government agencies, it does ask users to input their personal information in order to receive a “free guide” on how to apply for unclaimed stimulus checks.

Under the “Phishing” category on the IRS’s list, the agency says it “has seen a tremendous increase in phishing schemes utilizing emails, letters, texts and links” during its criminal investigation.

“These phishing schemes are using keywords such as ‘coronavirus,’ ‘COVID-19’ and ‘Stimulus’ in various ways,” according to the IRS. “These schemes are blasted to large numbers of people in an effort to get personal identifying information or financial account information, including account numbers and passwords. Most of these new schemes are actively playing on the fear and unknown of the virus and the stimulus payments.”

Seena Gressin, an attorney in the FTC’s Division of Consumer and Business Education, told VERIFY, “Identity theft is an equal opportunity scam. Anyone can become a victim. We urge all consumers to protect their personal information at all times.”

She also sent a list of tips on ways to avoid stimulus payment scams:

- Only use irs.gov/coronavirus to submit information to the IRS – and never in response to a call, text, or email.

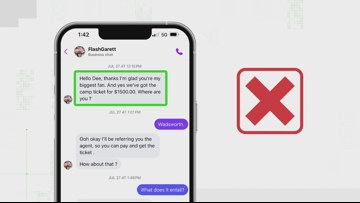

- The IRS won’t contact you by phone, email, text message, or social media with information about your stimulus payment, or to ask you for your Social Security number, bank account, or government benefits debit card account number. Anyone who does is a scammer phishing for your information.

- You don’t have to pay to get your stimulus money.

- The IRS won’t tell you to deposit your stimulus check then send them money back because they paid you more than they owed you. That’s a fake check scam.

“Also, watch out for emails and texts with attachments or links claiming to have special information about the payments. They’re fake, and they may be phishing for your personal information or might download malware to your computer, tablet, or phone,” said Gressin.

Searching for unclaimed money or property that’s not related to stimulus checks? The Treasury Department’s Bureau of Fiscal Reserve recommends The National Association of Unclaimed Property Administrators' website: www.unclaimed.org. On its website, the Bureau of Fiscal Reserve also shares a list of government agencies that have databases where you can search for unclaimed money.

More from VERIFY: Yes, the letter from President Biden mailed to stimulus payment recipients is real

VERIFY

Our journalists work to separate fact from fiction so that you can understand what is true and false online. Please consider subscribing to our daily newsletter, text alerts and our YouTube channel. You can also follow us on Snapchat, Twitter, Instagram or Facebook.