In 2021, the Federal Trade Commission received 2.8 million fraud reports, with more than $5.8 billion reported lost. The most commonly reported category were imposter scams, followed by online shopping scams.

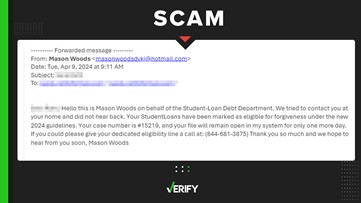

We often get questions from viewers about these different kinds of scams, a topic we cover a lot at VERIFY to help people avoid falling victim to one. But sometimes viewers reach out to us for guidance after fearing that they may have fallen for a scam.

Here are three things you can do to protect yourself after giving a scammer personal information or noticing suspicious activity on a device or account.

THE SOURCES

As soon as you realize your information may be compromised, it’s important to take action. Here are steps you can take:

1. Report the scam to police, your banking institutions and credit bureaus

If your personal information, like your Social Security number, was compromised – or if you were scammed out of money – you should contact the police, your bank and the three major credit bureaus.

To file a police report on a scam, you will need to make a call or visit the fraud division of your local police department. Before calling, gather records and information. Here are some examples of what to bring:

- Bank statements or credit card charges

- Emails

- Phone and text call history

- Screenshots

- Links to websites

Contact your bank or financial institution if you shared payment information with the scammer.

If you paid with a credit or debit card, or had an unauthorized transfer from your account, you can tell the bank that it was a fraudulent charge and ask them to reverse the transaction or give you your money back. You can also ask for refunds if you sent a wire transfer through a company like Western Union or MoneyGram.

If you give a scammer your social security number, they have the ability to take out lines of credit – like applying for loans or credit cards. If that’s the case, you should contact the three major credit bureaus and place a freeze on your credit.

“Doing so prevents lenders and others from accessing your credit report entirely, which will prevent them from extending credit,” the Tennessee Office of the Attorney General says.

According to Equifax, one of the major credit bureaus, the security freeze restricts access to the credit report so people can’t extend credit in your name. When you want to apply for credit, or when you know your credit is safe, you can request to temporarily or permanently remove the security freeze.

Here is how to contact the three major bureaus:

Equifax

- https://www.equifax.com/personal/credit-report-services/

- (800) 525-6285

Experian

- https://www.experian.com/fraud/center.html#content-01

- (888) 397-3742

TransUnion

- https://fraud.transunion.com/fa/fraudAlert/landingPage.jsp

- (800) 680 -7289

These credit bureaus can also add fraud alerts to warn potential credit grantors that you may be a victim of identity theft.

Experian says once you detect and report the fraud, the fraudulent transactions or accounts can be removed and will no longer impact your credit score.

More from VERIFY: How to avoid credit repair scams

2. Change your passwords and add two-factor authentication to your accounts

The FTC says “passwords are the locks on your account doors.”

A lot of personal information is kept in online accounts, including your email, bank account, and your tax returns, so changing your password is key. Here are tips to consider when creating a new password:

- Make sure the password is at least 12 characters long

- Don’t use the same password for multiple accounts

- Set up multi-factor authentication, or two-factor authentication requirements

- Choose a password manager, like LastPass, that helps keep track of passwords

- Pick a security question only you know the answer to

Get Cyber Safe, a public awareness campaign created in Canada, has this helpful YouTube video on choosing a strong password.

By setting up two-factor authentication, if you or someone else tries to get into one of your accounts, an alert will be sent to an application or a code will be sent via text message.

No one will be able to log into your account, even if they have the password, if they don’t have the additional code.

If you are already locked out of an account and you didn’t set up another security measure, like a security question or back-up email account, you would need to contact customer service.

If someone is using your information to open new accounts or make purchases, you can get help at IdentityTheft.gov.

More from VERIFY: 5 tips to spot email scams

3. Check your computer and other devices

Scammers are not only trying to target your accounts or your funds, they could have also infiltrated your computer. According to the Minnesota Office of the Attorney General, scammers do this by making unsolicited phone calls or placing misleading pop-up ads to try to sneak malware or viruses into a computer.

Here’s what to do if you think your devices have been hacked by scammers:

- Check to make sure that your antivirus program is up-to-date and running and that your system is free of malware and keylogging software. If the computer is unable to run any programs, disconnect it from the internet and take it to a reputable computer technician for inspection.

- If a scammer took control of your cell phone, contact your mobile service provider. Most major mobile service providers could disable the phone service at your request.

Once you have access to your devices again, change your passwords and pin numbers.

If you or someone you know was the victim of a scam, you can file a report online with the FTC, or call them at 877-382-4357. You can also report scams to the FBI’s Internet Crime Complaint Center or the BBB’s Scam Tracker.

More from VERIFY: Watch out for these common holiday scams