UPDATE (6/30/23): The Supreme Court has struck down the Biden administration's one-time student loan forgiveness plan. Loan repayments are expected to resume later this summer. You can read more information here.

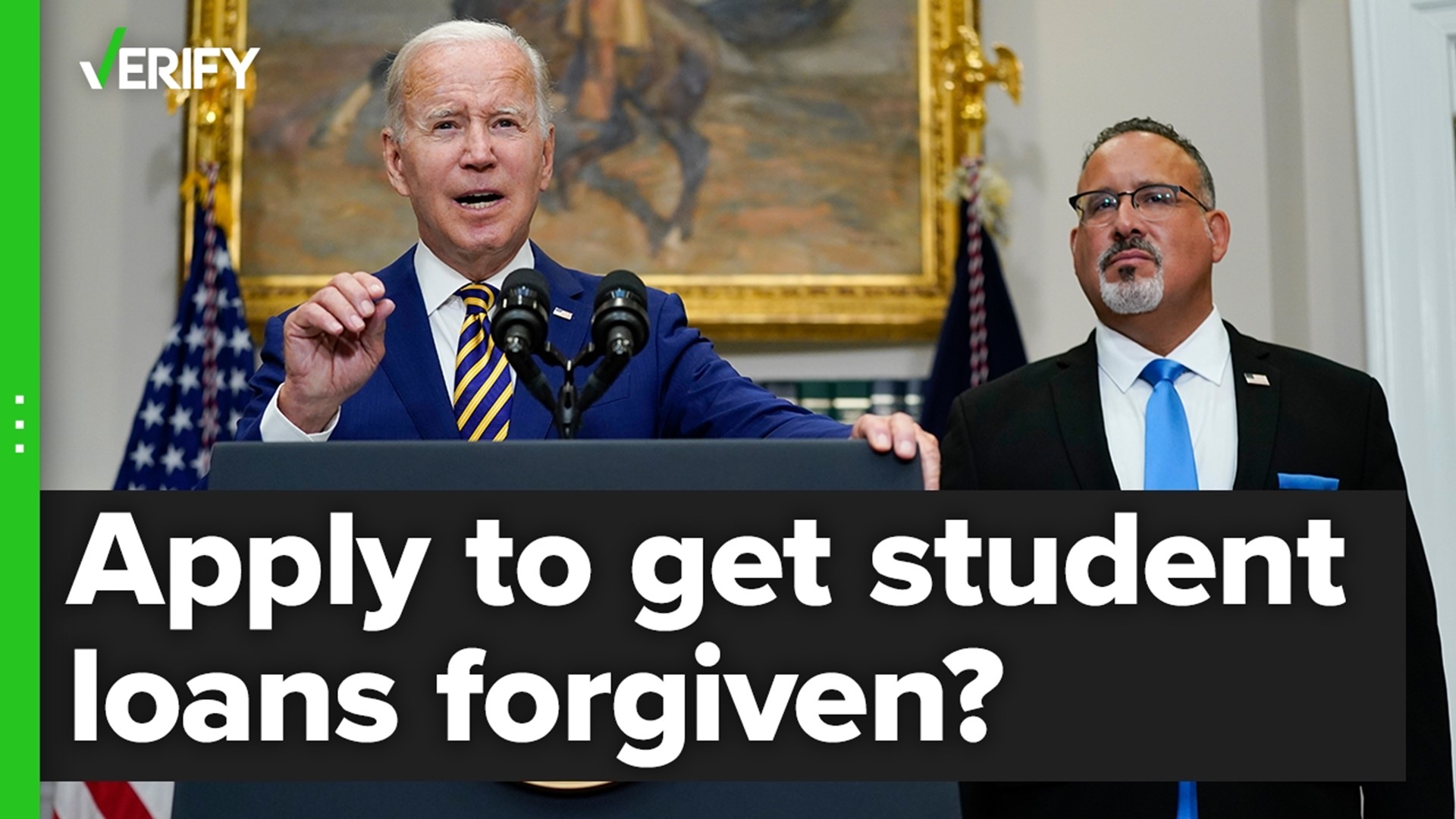

President Joe Biden announced on Aug. 24 that his administration would forgive between $10,000 and $20,000 of federal student loan debt for borrowers making less than $125,000 per year.

Federal Pell Grant recipients who meet the income requirements would be eligible for $20,000 in student debt forgiveness.

In the announcement, Biden also said he extended the student loan pause for a “final time” through Dec. 31, 2022.

VERIFY has received many questions from our readers about what the student loan forgiveness plan means for them, including if they have to apply for loan forgiveness and whether debt forgiveness will be considered taxable income, among others.

Here’s what we know right now about the Biden administration’s student loan forgiveness plan.

THE SOURCES

- The White House

- The U.S. Department of Education

- American Rescue Plan of 2021

- Jessica Thompson, vice president at the Institute for College Access and Success

- Abby Shafroth, director of the Student Loan Borrower Assistance Project at the National Consumer Law Center

- The American Bar Association

WHAT WE FOUND

Is the $125,000 income limit for individuals or married couples?

Borrowers are eligible for student loan forgiveness if their income is less than $125,000 for individuals, and less than $250,000 for married couples or heads of households, according to a White House fact sheet and the U.S. Department of Education.

If a person's income in either the 2020 or 2021 tax years was below these income caps, they are eligible for debt forgiveness, senior officials with the Biden administration said.

Will you automatically receive student loan forgiveness?

Nearly 8 million borrowers may be eligible to receive automatic forgiveness because the Department of Education has relevant income data.

Abby Shafroth, director of the Student Loan Borrower Assistance Project at the National Consumer Law Center, told VERIFY that roughly 6 million out of the 8 million borrowers are those whose families recently completed the Free Application for Federal Student Aid (FAFSA).

The other 2 million borrowers are those who recertified their income as part of an income-based repayment plan.

But the Department of Education likely doesn’t have income data for millions of other borrowers since they haven’t been required to update it during the student loan payment pause, according to Shafroth and Jessica Thompson, vice president at the Institute for College Access and Success.

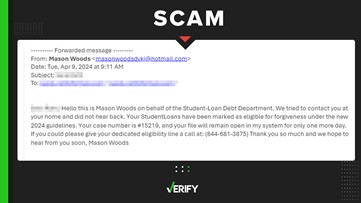

If the department doesn’t have your income data, you can complete an application that became available on Oct. 17, 2022. People have until Dec. 31, 2023 to apply.

The application was released in a "beta" format on Friday, Oct. 15. Any student borrower who applied during the beta launch will not have to reapply to receive forgiveness.

The form is currently online-only, although it can be filled out both from mobile and from desktop. It comes in two languages: English and Spanish.

More from VERIFY: Yes, the student loan forgiveness application is now open

Who qualifies for Pell Grants and how do you know if you received one?

Pell Grant recipients, who will receive $20,000 in student debt forgiveness if they meet the income requirements, make up more than 60% of the student loan borrower population, according to the White House. The Department of Education estimates that roughly 27 million borrowers with Pell Grants will be eligible for up to $20,000 in student debt relief.

Pell Grants are usually awarded to undergraduate students who “display exceptional financial need." Unlike loans, Pell Grants do not have to be repaid except under certain circumstances.

The amount a borrower receives through a federal Pell Grant award is based on their Expected Family Contribution, cost of attendance at their school, status as a full or part-time student, and plans to attend school for a full academic year or less. Pell Grant amounts change yearly and the maximum award for the 2022-2023 school year is $6,895.

A borrower’s school can apply Pell Grant funds directly to their costs, pay the borrower directly, or combine these methods, the Department of Education said.

If you’re not sure whether you received a Pell Grant when taking out student loans, the easiest way to check is to log into your Federal Student Aid account at studentaid.gov, Thompson said.

You’ll find the information about whether you received a Pell Grant on your aid summary page.

Thompson added that you shouldn’t need to prove you’ve ever received a Pell Grant to the Department of Education.

“They should be able to identify, and certainly have the data to know, who has ever been disbursed a Pell Grant,” she said.

It’s unclear right now if the Biden administration will launch another way for borrowers to verify this information.

More from VERIFY: Yes, there is a way to check if you received a Pell Grant

Do Parent PLUS Loans qualify for debt forgiveness?

Parent PLUS loans, which are issued to parents of dependent undergraduate students, are meant to supplement other financial aid offers. These borrowers are eligible for student loan forgiveness, senior Biden administration officials told reporters.

Parents with these loans and students are each eligible for debt forgiveness, the Department of Education confirmed in an email to VERIFY.

“If both the student and the parent received a Federal Pell Grant, each person would be eligible to receive the additional $10,000 in debt cancellation,” the department added.

More from VERIFY: Yes, Parent PLUS loans are eligible for debt forgiveness

Do graduate loans also qualify for debt forgiveness?

Yes, debt accrued from federal graduate loans is eligible for forgiveness if the loans are held by the Department of Education, according to Shafroth and other experts.

“We have confirmed that graduate student borrowers will be included in this cancellation,” Thompson said. “So again: same income thresholds, same amounts.”

More from VERIFY: Yes, graduate loans are eligible for loan forgiveness

Are current college students eligible for student loan forgiveness?

Current college students with loans are eligible for debt relief, the White House says in its fact sheet. If the borrower is a dependent student, they will be eligible for relief based on their parents’ income rather than their own ($125,000 for individuals or $250,000 for couples).

The cancellation announcement specifically applies to current students who took out their loans before July 2022, experts told VERIFY.

More from VERIFY: Yes, some current college students qualify for student loan forgiveness

Can you get a refund if you made payments during the pause?

Yes, you can get a refund if you paid federal student loans during the payment pause.

Borrowers who paid between March 13, 2020, and Aug. 23, 2022, and now owe less than the $10,000-$20,000 threshold, should request a refund so they can get the full amount forgiven.

Any amount paid after Aug. 24, 2022 that brings a borrower below the threshold will automatically be refunded without the borrower requesting it.

More from VERIFY: Yes, you can get a refund if you paid federal student loans during the payment pause

Will student loan debt relief be treated as taxable income?

No, student loan debt relief will not be treated as taxable income on your federal income tax return, according to the White House.

This rule was established by the American Rescue Plan of 2021, which specified that student loan forgiveness would not be taxed through 2025.

States could decide to tax money forgiven by the federal government as income. So far, no states have announced that they will tax forgiveness, and at least one has said it will not.

More from VERIFY: You won’t have to pay federal taxes on student debt relief, but states could tax it as income

Are some loans excluded from debt cancellation?

Borrowers with FFEL Loans and Perkins Loans that aren’t held by the Department of Education are excluded from student debt forgiveness, Shafroth said. These loans also haven’t been included in the payment pause that began in March 2020.

The American Bar Association explains on its website that FFEL Loans are usually issued by banks, savings associations and credit unions, rather than the federal government.

Perkins Loans aren’t owned by the Department of Education, either. They’re issued by schools, even though they use funds provided by the federal government, according to the American Bar Association.

These borrowers previously had the option of consolidating their FFEL and Perkins loans that are not held by the Department of Education to be eligible for student debt relief, but they must have already done so before Sept. 29, 2022.

More from VERIFY: Yes, a change to the student loan forgiveness plan excludes some borrowers from relief

Though private student loans don’t qualify for the federal debt forgiveness plan, either, there have already been some targeted student loan cancellation programs for these borrowers. One of these is the Navient settlement, which cancels loan balances for approximately 66,000 borrowers with certain qualifying private loans.

If you have less than $10,000 or $20,000 in debt, will your loans still be forgiven?

The Department of Education explains that relief is capped at the amount of a person’s outstanding debt.

For example, people who are eligible for $20,000 in debt relief but have a balance of $15,000 will receive $15,000 in debt relief.

Does the student loan forgiveness plan change anything for income-driven repayment?

To address concerns about monthly payments, the Biden administration is proposing a rule to reduce the amount for monthly payments from 10% to 5% of a person’s discretionary income. This is your income after taxes and other living expenses.

The rule would also guarantee that no borrower earning under 225% of the federal poverty line will have to make a monthly payment on their student loan debt. Borrowers’ unpaid monthly interest would also be covered so nobody’s loan balance will grow as long as they make their monthly payments.

Additionally, loan balances would be forgiven after 10 years of payments, rather than the existing 20 years, for borrowers with $12,000 or less in debt.

VERIFY digital journalists Emery Winter and Erin Jones contributed to this report.